Central Florida's Best Choice For

Solar & Roofing

We Offer All Kinds Of Professional Modern Solar & Roofing Services

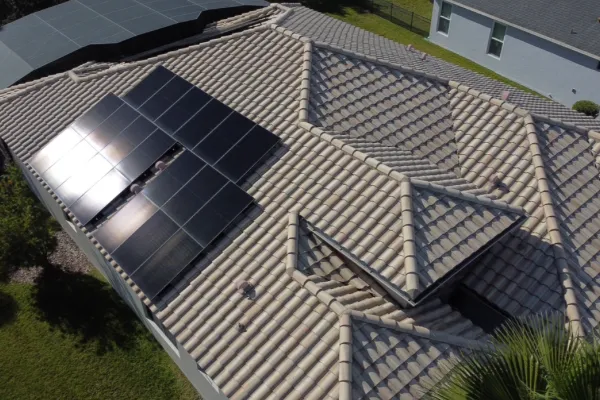

Rooftop Solar Panels

Professional rooftop solar installation services for homes and businesses, ensuring the seamless integration of solar panels to harness renewable energy and save money.

Ground Mounted Solar Panels

Expert ground-mounted solar panel installation services offer efficient and cost-effective solutions for harnessing renewable energy, maximizing sunlight exposure, and reducing electricity costs.

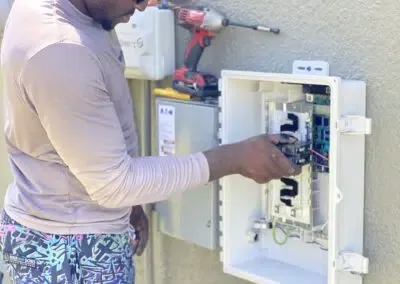

Emergency Backup Solutions

Emergency home battery system installation provides reliable backup power during outages, ensuring uninterrupted electricity supply, increased energy independence, and peace of mind for homeowners in times of need.

Storm Damage

Central Florida's leading experts in storm damage repairs provide efficient and reliable services to repair roofs affected by severe storms, ensuring durability and safety for homeowners.

Complete Roof Replacement

Professional roof replacement installation services offer expert craftsmanship and durable materials, ensuring a long-lasting and aesthetically pleasing roof that enhances the protection and value of your home.

Reroof + Solar Removal/Reinstall

Comprehensive solar panel removal, new roof installation, and panel reinstallation services ensure a seamless transition, maximizing energy efficiency and preserving the integrity of your solar investment.

Auxiliary Services

In addition to solar installations, WattSun Solar and Roofing provide auxiliary services like panel cleaning, system pest protection, and maintenance, ensuring optimal performance, cleanliness, and protection of your solar system.

Personalized Attention: We offer personalized service and tailored solutions.

Community Connection: Supporting local business contributes to our community's economic growth.

Reputation and Trust: We have a vested interest in maintaining a strong reputation.

Local Expertise: Familiarity with local regulations and conditions ensures smooth installations.

Long-term Commitment: We prioritize customer satisfaction and long-term relationships.

Why choose WattSun for your Roofing and Solar needs?

At WattSun, you can expect a personalized and customer-centric approach, as we prioritize building strong relationships within the community. Our vested interest in customer satisfaction translates into attentive service, tailored solutions, and ongoing support

As a local family-owned business, we have deep roots in the area, making us more invested in the long-term success of your solar system. Our reputation is built on word-of-mouth referrals and positive reviews, which incentivizes us to provide exceptional quality and reliable workmanship. Additionally, by choosing a local company, you contribute to the local economy, supporting local jobs and fostering community development.

Ultimately, a local family-owned company like WattSun Solar and Roofing brings a level of care, attention, and commitment that goes beyond a mere business transaction. We strive to exceed expectations, provide personalized guidance, and build lasting relationships, ensuring your solar installation journey is seamless, trustworthy, and rewarding.

Our Projects

10,444,532+

kWh of Energy Produced

$1,061,117+

Savings for our Clients

Request a Quote

By providing my contact information, I agree to receive text messages, emails, or phone calls from the WattSun Solar and Roofing.

What our Customers Say

"Our Experience with WattSun was outstanding. Cayden was our first point of contact, and he made sure we understood everything we needed to choose and install the right system, size, production, warranties, and loan... The crew of installers were very professional and friendly. Communication was great, the job was done in less than two days and the finishes were super clean.

I would definitely recommend WattSun to my family and friends"

Joel Martinez

Google Review

"Everyone at WattSun has been incredible to work with. The sales team did not pressure us. He provided the information, listened to what our plans were and confirmed if he was able to provide what we were looking for. During the process, we were kept up to date on the progress and timeline. The installation was seamless and the team did an amazing job. Everyone was great to work with and I would recommend WattSun to anyone looking to learn about solar or to purchase!"

Casey Strong

Google Review

"We love WattSun! After being in our home for a few years and seeing our electric bill creep up each month, we decided to go solar. Cayden walked us through the whole process and was extremely patient. I love how responsive they are and how easy the installation process was. This company has great communication, which is hard to come by these days. My only regret is not going solar sooner. Highly recommend!"

Alison Cowen

Google Review

Solar Frequently Asked Questions

How much do solar panels cost?

The cost of solar panels varies based on factors such as system size and equipment quality. Take the first step towards solar by requesting a personalized cost estimate for your home from WattSun Solar and Roofing.

What is the payback period for solar panels?

The payback period typically ranges from 5 to 15 years, depending on factors like energy usage, incentive qualification, sun access, and more. Let us calculate your potential savings and determine your payback period with our free solar assessment. Contact us today to schedule.

How much can solar panels save on electricity bills?

Solar panels can significantly reduce electricity bills, potentially leading to savings of 20-100% depending on usage, system size, and utility company sellback rates. Discover how much you can save on your electricity bills by scheduling a consultation today.

Is my home suitable for solar panel installation?

Most homes can accommodate solar panels, but an on-site assessment is needed to determine feasibility and optimal placement. Roof angle, shading, home positioning, and roof age need to be considered when determining feasibility. Find out if your home is suitable for solar and schedule a site evaluation to explore your options.

What incentives and rebates are available for solar panel installation?

Incentives and rebates vary by location but can include federal tax credits, state-level incentives, and utility company programs. Explore available incentives and rebates in your area to maximize your solar investment. Contact us to learn more.

How long do solar panels last?

Solar panels today typically have a manufacturer's warranty of at least 25 years. This includes guaranteed output levels at the end of that time frame of at least 80%. Discover the long-term benefits of solar and schedule your installation consultation today.

Can solar panels work during a power outage?

Yes, with the addition of battery storage, solar panels can provide backup power during outages. Contact us to learn more about our reliable solar + storage solutions.

Do solar panels require maintenance?

Solar panels are low-maintenance, requiring occasional cleaning and inspections. Ensure optimal performance by scheduling regular maintenance with our experienced team.

How much space is needed for solar panel installation?

The space needed for solar panel installation depends on the size of the system and power usage. Request a free site evaluation to determine the solar potential of your property.

Are there financing options available for solar panel installation?

Yes, we offer a range of financing options to suit your budget. From loans to leasing, we have solutions to make solar installation affordable for you. Contact us to explore financing options and start your solar journey without breaking the bank.

Still Have Questions? Contact us and our team of experts will assist.

WattSun Solar and Roofing Blog

How Do Grid-Tied Residential Solar Systems Work? Explained for Homeowners

Discover how grid-tied residential solar systems work. Learn about components, working principle, benefits, and cost savings. ...more

resources

May 17, 2023•3 min read

The Decreasing Price of Solar: Will Solar Get Cheaper?

Discover the journey of declining solar panel prices. Technological advancements, scale, competition, and installation efficiency have made solar energy more affordable. ...more

resources

April 19, 2023•3 min read

Get In Touch

Assistance Hours

Mon – Sat 9:00am – 8:00pm

Sunday – CLOSED

Phone Number:

Instagram: @wattsun.solar.roofing

License Numbers

Solar: CVC57055

Roofing: CCC1333809

Office:

2578 Clark St. Suite 5, Apopka FL 32703

Call

Email:

Site: